Faculty Spotlight - Dennis Ridley, Ph.D.

Innovation Growth Macro-Economics and Capitalism, Democracy, Rule of Law (CDR)

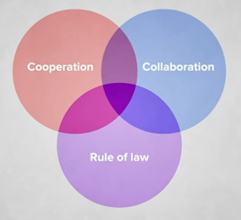

Dennis Ridley, PhD and Andrea Nelson’s, JD combined scholarship; expressed through the theories of Innovation-Growth Macroeconomics, the Capitalism-Democracy-Ruleof Law (CDR) model, andtheir books The Mystery of Wealth: Capitalism, COLLABORATION Trumps IQ, and The Wealth Gene; offers a unified and comprehensive explanation of how societies generate prosperity and why wealth emerges unevenly across nations, organizations, and individuals. Their central argument is that economic development is driven less by natural resources, geographic advantages, or traditional capital accumulation, and far more by the activation of intangible capital such as creativity, human ingenuity, institutional trust, entrepreneurial capacity, and above all, collaboration. Innovation-Growth Macroeconomics reframes economic progress as the transformation of intangible capital; ideas, knowledge, innovation, and social institutions; into tangible economic output, leading to rising standards of living. This transformation, they argue, occurs reliably only within a strong institutional environment defined by capitalism, democracy, and rule of law. These three components form the CDR model, which Ridley and Nelson support with empirical research showing that the interaction; not the isolated presence; of free markets, democratic governance, and a stable and impartial legal system explain most of the variation in per-capita GDP across countries and even within the United States. Capitalism supplies incentives, competition, and freedom of exchange that fuel innovation; democracy protects personal and political freedoms necessary for risk-taking, dissent, and entrepreneurial experimentation; and rule of law ensures secure property rights, contract enforcement, and predictable conditions that allow trust and investment to flourish. When these institutions reinforce one another, societies create an environment in which Innovative Economics thrives, innovation becomes scalable, and human potential transforms into real economic growth.

Their books deepen and humanize this theoretical framework. The Mystery of Wealth: Capitalism demonstrates that prosperity is not random but emerges systematically in societies where CDR institutions are strong. COLLABORATION Trumps IQ argues that while intelligence matters, true economic progress depends on purposeful collaboration; coordinated, intentional, and mutually beneficial effort; because collaboration is what enables societies to build rule of law, sustain high-trust environments, and generate the large-scale innovations required for sustained growth. Mere cooperation, focused on private gain, is not enough and may even impede progress. The Wealth Gene further explores why wealth clusters across individuals or groups, proposing that “wealth genes” are not just static biological traits but durable behavioral and institutional patterns; creativity, risk tolerance, trust-building, and collaborative ability; that replicate prosperity across generations, especially when supported by strong CDR structures. Taken together, these concepts and books form a comprehensive theory of economic and social development, asserting that wealth arises when innovative human potential is activated within institutions like the Florida A&M University School of Business and Industry designed to protect freedom, encourage collaboration, and translate ideas into productive economic reality.

"Dennis Ridley has written a fascinating study of the ultimate enigma in economics, the mystery of wealth, using the ultimate tool of modern science, information theory. "

What scholars say:

“This book is well written. It is a mind changer. It gives a thorough and complete

economic theory of entrepreneurship. It comes alive when the theory connectsentrepreneurship,

capitalism, democracy and rule of law to the industrial revolution. While the findings

are contrary to popularly held beliefs, the explanations, demonstrations and proofs

are compelling and undeniable. It provides a convincing case that the only source

of wealth is entrepreneurship via human ideas of imagination and creativity. Therefore,

entrepreneurship education must be redesigned to exploit this understanding. Economics

education will change forever.”

“This book is well written. It is a mind changer. It gives a thorough and complete

economic theory of entrepreneurship. It comes alive when the theory connectsentrepreneurship,

capitalism, democracy and rule of law to the industrial revolution. While the findings

are contrary to popularly held beliefs, the explanations, demonstrations and proofs

are compelling and undeniable. It provides a convincing case that the only source

of wealth is entrepreneurship via human ideas of imagination and creativity. Therefore,

entrepreneurship education must be redesigned to exploit this understanding. Economics

education will change forever.”

Randall Holcombe, Ph.D. Economics, Virginia Polytechnic Institute and State University,

USA.

“The author has done a nice job of two stage least squares to separate total capital

into exogenous human capital and endogenous capital stock of knowledge, recordings

and machines, etc. The finding that human capital is 85% just tells how very much

capital stock is subject to depreciation and obsolescence. I would not have guessed

that natural resources contribute only 6% to GDP. I always thought it contributed

much more and was the most important factor in economic development. Similarly, it

was surprising but interesting to learn that geography only contributes 4% to GDP.”

Aryanne D. de Silva, Ph.D. Psychology, University of Notre Dame, USA.

“Many authors have suggested that capitalism, democracy and rule of law are important

for economic growth, but CDR is the first mathematical model to predict approximately

90% of GDP. I was surprised so I obtained the data from the book and tested it myself.

The results were astonishingly. Finally, we have a sound scientific economic growth

model. The implication is that the conversion of capital to GDP is determined by the

laws of natural sciences and is the same in all countries in the world. What is commonly

thought to be differences in productivity is actually the differences in the amount

of capital that countries can attract for conversion to GDP. It is now clear that

the true and only source of wealth is human capital ideas of imagination and creativity

and it can only be converted in the presence of catalysts: democracy and rule of law.

Poor countries can now focus on these features of society with confidence that life

can get better. Noneffective strategies such as government spending can be put to

bed. There is no good reason why the implementation of the CDR concept cannot serve

to end poverty and build middle class societies all around the world.”

Pierre Ngnepieba, Ph.D. Mathematics, University of Grenoble-Alpes, France.

“The author provides a pedagogical suite of proposals for revising entrepreneurship,

economics, engineering and mathematics courses. They include sample syllabi designed

to better develop science, technology, engineering and mathematics (STEM), and entrepreneurial

concepts and creative thinking in higher education. This is the definitive economic

theory of entrepreneurship.”

John Washington, JD, University of Florida, USA.

The CDR model quantifies the proposition “Every individual is continually exerting himself to find out the most advantageous

employment for whatever capital he can command. It is his own advantage, indeed, and

not that of the society that he has in view. But, the study of his own advantage naturally,

or rather necessarily, leads him to prefer that employment which is most advantageous

to society… He intends only his own gain, and he is in this, as in many other cases,

led by an invisible hand to promote an end which was no part of his intention. By

pursuing his own interest, he frequently promotes that of the society more effectually

than when he really intends to promote it.”

Adam Smith, LL.D., University of Glasgow, Scotland. Father of modern economics and

capitalism.

Books:

- The Mystery of Wealth: Capitalism. Democracy. Rule of Law

- COLLABORATION trumps IQ: ENTREPRENEURSHIP (CDR Innovation Economic Growth Model)

- The Wealth Gene: why 10% are rich while 90% are poor (CDR Innovation Economic Growth Model)

- The Source of Wealth: Innovation Economics (CDR Innovation Economic Growth Theory)

Resources: